Does Renters Insurance Cover Theft?

Here's everything you need to know about renters insurance and theft.

Here's everything you need to know about renters insurance and theft.

Yes, renters insurance covers theft, whether it happens at home or while you’re traveling—even internationally. Let’s break down what you need to know about theft coverage.

Your renters insurance will cover most of your stuff for theft both inside and outside your home, including electronic items, furniture, clothing, and jewelry – as long as you’ve purchased enough coverage for them (more on this later).

Let’s say you go out for a movie with a friend, and come home to find that a burglar broke into your place and stole your TV, computer, sound system, and your friend’s backpack which had a laptop and headphones inside. Ouch.

Would you be covered? Yes.

Your and your friend’s stuff would be covered, provided they don’t have a policy of their own. Just make sure you can provide a full inventory of what was stolen, make and model, receipts, and pictures if possible. The more info you can get, the easier it will be for your claims adjuster and insurance company to process your claim.

One of the best things about renters insurance is that you’re also covered for theft outside of your home. That means you’re protected if your laptop gets stolen from the local coffee shop, or if someone pickpockets your phone on the subway, or even if your favorite handbag is stolen during a mugging.

And what’s the radius of that coverage? Your personal belongings are even covered from theft while you’re abroad!

So let’s say you’re on a business trip, and return to your hotel with your iPad nowhere to be found. Or, your phone was swiped while dancing at a music festival — your renters insurance policy could have you covered. In short, there are a lot of common situations renters insurance covers you for.

Filing a theft claim? It’s a good idea to know your personal property coverage limit and deductible. Here’s a breakdown of what they are and how they work.

When you have renters insurance, your personal property coverage (AKA Coverage C) is what protects all your stuff. The coverage limit is the maximum amount your insurance will pay if your belongings are damaged or stolen, and you choose this limit when you buy your policy.

To figure out how much coverage you need, a good rule of thumb is to add up the value of everything you own and round to the nearest $10,000. For example, if your things are worth $36,000, you’d want a coverage limit of $40,000 to make sure you’re completely covered.

Some types of items, like jewelry, have smaller sublimits under your policy. For example, a standard renters insurance plan might only cover jewelry theft up to $1,500—even if your total coverage limit is much higher.

But here’s the good news: You can schedule personal property like engagement rings, fine art, or musical instruments (what we at Lemonade call adding Extra Coverage) to make sure they’re covered up to their full worth. The items that have Extra Coverage will also be covered for accidental damage and mysterious disappearance, deductible-free!

Hot tip: In the unfortunate case you need to file a claim for theft, make sure you have all the documents, receipts, police report, and any other info handy for a swift claims process.

Your renters insurance deductible is the amount of money you’re responsible for paying out of pocket when filing a claim. Think of it as your share of the bill for replacing or repairing stolen items. At Lemonade, you can pick your deductible amount anywhere from $250 to $2,500 when you sign up for coverage.

Here’s the trade-off to consider when choosing your deductible. A lower deductible means higher monthly premiums, but your insurance will cover more of the cost if you file a claim. On the flip-side, a higher deductible lowers your monthly price but increases how much you’ll have to spend when something goes wrong.

Deciding on the right deductible is all about balance. Think about how much you’re comfortable paying each month versus how much you’ve got saved up to handle unexpected costs.

While renters insurance covers a lot of theft scenarios, there are some exclusions to keep in mind:

It’s great to have insurance when something is stolen, but let’s be honest—we’d really rather it not happen at all. Here are some ways to reduce the likelihood of theft:

1. Lock it up

When you move into your new rental, invest in some new locks! Your landlord might even agree to buy these for you. That way, you won’t have any creepy unplanned visits from old tenants or be vulnerable to burglary. Also, make sure to never write any part of your address on your keys (or anywhere else).

2. Keep your eyes open

If anyone asks to enter your home, always double and triple check. A ‘maintenance worker’ might want to enter under the guise of fixing something in the property — or they might claim your landlord sent them.

We’re more likely to be lax about security when it’s someone else’s property, but it’s good sense to never let anyone into your home unless you’ve been told first by your landlord, or if they have an official badge that checks out.

Also, get to know your neighbors, and who comes in and out of the building regularly. If there are any unfamiliar faces lurking around, you might want to inform the authorities.

3. Get digitally secure

It may feel like it’s just you and your friends Instagramming, but be aware, cyberspace can be a dark place. Keep track of what sort of information you post online, and ensure your home address or phone number aren’t publicly available. Criminals can use clues like phone numbers or home addresses to fraud authorities and potentially break into homes.

4. Stay safe!

Let’s be honest, life ain’t a piece of cake. We encounter all sorts of obstacles along the way—and theft is, unfortunately, one of ‘em.

Getting renters insurance is just good sense and covers you for more incidences than just theft. No matter how much your belongings are worth, when s**t hits the fan, you’ll be glad you had renters insurance.

BTW, in case you were wondering about states with the highest property crime rates, according to USAFacts (FBI data) New Mexico had the highest property crime rate in 2024, at 2,751 offenses per 100,000 people, while Idaho had the lowest at 736. Property crimes include burglary, larceny-theft, and motor vehicle theft. For additional information on theft and how you can keep your home safe, check out our guide to some of the most eye-opening burglary statistics.

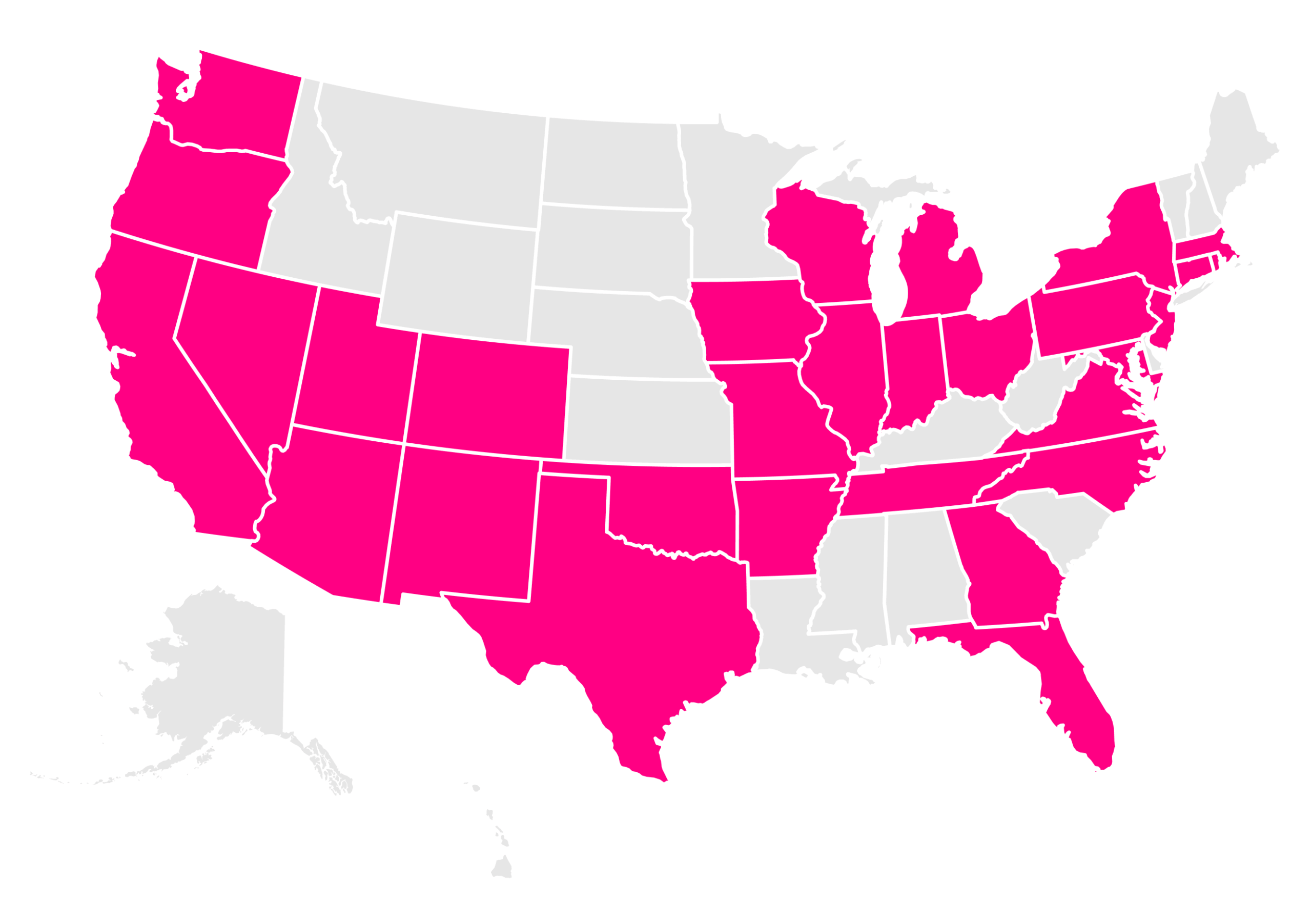

Arizona, Arkansas, California, Colorado, Connecticut, Florida, Georgia, Illinois, Indiana, Iowa, Maryland, Massachusetts, Michigan, Missouri, Nevada, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, Tennessee, Texas, Utah, Virginia, Washington, Washington, D.C. (not a state… yet), and Wisconsin.

Have more questions about renters insurance? Check out our guide to renters insurance coverage.

Yes, renters insurance typically covers bike theft, whether the bike is stolen from your home or another location. This falls under personal property coverage, which reimburses you for the value of stolen belongings.With a standard renters insurance policy, your bike is covered up to your personal property coverage limit, but you’ll still need to meet your deductible. If you want to insure your bike for its full value—and your bike is worth more than $350—consider adding Extra Coverage, or “scheduling” your bike.With Lemonade’s Extra Coverage, you’ll be reimbursed up to the full replacement cost on eligible claims—without paying a deductible (and have more protection against things like accidental damage and mysterious loss).

No, renters insurance doesn’t cover car theft or damage to your car from a break-in. Car damage is covered under your auto insurance—if you have comprehensive coverage.However, renters insurance can cover personal items stolen from inside your car, such as a laptop or purse.

Yes, renters insurance can cover stolen cash, but coverage is often very limited. Policies typically set low limits on cash reimbursement, such as $200 or $300, regardless of the total amount stolen. At Lemonade, the sub-limit for stolen money is $200.This cap exists because cash and similar items fall under a special sub-limit on the policy, which means $200 is the maximum reimbursement available, regardless of the total amount stolen. To protect larger sums of money, consider using a secure bank account rather than keeping cash at home or in your wallet.

Yes, renters insurance can cover stolen laundry if the clothes belong to you and were stolen from a shared laundry room or another location. This would fall under your personal property coverage. Keep in mind: just like any other claim, you’ll need to meet your deductible before you’re reimbursed.

you’re reimbursed quickly:

Your insurer will guide you through the next steps, and it’s always a good idea to review your policy so you’re prepared.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage and discounts may not be available in all states.

Please note: Lemonade articles and other editorial content are meant for educational purposes only, and should not be relied upon instead of professional legal, insurance or financial advice. The content of these educational articles does not alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. While we regularly review previously published content to ensure it is accurate and up-to-date, there may be instances in which legal conditions or policy details have changed since publication. Any hypothetical examples used in Lemonade editorial content are purely expositional. Hypothetical examples do not alter or bind Lemonade to any application of your insurance policy to the particular facts and circumstances of any actual claim.