How to Buy Lemonade Pet Insurance

Follow these simple steps to get your fur fam covered in no time!

Follow these simple steps to get your fur fam covered in no time!

If you’re reading this, you’ve already figured out that being a pet parent comes with a lot of responsibility—and yes, that includes financial responsibility.

From fancy food to vet visits and grooming sessions, the costs can add up quickly. Getting pet insurance for your furry family member is a smart move to help cover their medical expenses so they receive the best care possible, without needing to worry about your wallet.

Let’s take a walk through the process of signing up for Lemonade pet insurance, with step-by-step instructions and helpful tips along the way.

Got more than one pet? We love a fur fam! You’ll need to sign them up separately so they each get the right coverage and their own policy. You’ll also be eligible for Lemonade’s multi-pet discount.

On a mobile device:

Download the Lemonade app on the Apple App Store or Google Play Store. Once in the app, start your account by filling out your name and email address. Then, select Pet Health Insurance. Easy breezy.

If you’re using a computer:

See that big, pink ‘Get Your Quote in Seconds’ button at the top of this article? Go ahead and click it. Enter your name and email, select Pet Health Insurance, and you’re ready to go.

Maya will start off by asking a few basic questions to get to know you and your furry friend better. What sort of stuff? Well, information like where you live, whether your pup Luna is a boy or girl, and details on their age, breed, and weight. This helps us design the best coverage for your pet.

Once you’ve answered all of Maya’s questions, your basic quote is ready!

(FYI, Maya can also help you get homeowners, renters, or term life insurance… and if your home or apartment is insured with Lemonade, you can get a 10% bundle discount on your pet’s insurance.)

The amount shown in your quote is the monthly premium, or how much you’d pay each month for the standard accidents & illness coverage. That means something like a broken leg or an injury from a car accident could be covered, as would a mysterious stomach bug. If your pet has an injury, vomiting, diarrhea, infections, hip dysplasia, cancer, or many other illnesses we hope they never have to experience, a standard policy will help cover the costs of things like:

Your premium is calculated based on your pet’s breed, age and location (yeah, veterinary care costs aren’t the same in New York and California). But you don’t have to stop there. If you’d like, before enrollment, you can customize and add to your policy in various ways.

Choose monthly or annual payments. You can select an annual payment plan or a month-by-month payment. Your choice!

Select add-on packages. If you want to get more coverage for your pet, Lemonade offers add-on packages:

Adjust your co-insurance, annual limit and annual deductible. What does that mean?

Learn more about customizing your coverages here.

Once you’ve customized your coverage and provided payment details, a copy of the policy will be emailed to you. Because we can’t guarantee that you’ll be able to make coverage upgrades after the first 14 days, or after a claim is filed, it’s best to start with the coverage you would want for the lifetime of your pet. In most states*, you can request to decrease your coverage at any time.

While most insurance companies keep everything for themselves, we give back through the Lemonade Giveback program.

Choose a cause you care about from the list, and part of what you pay will support nonprofits throughout the year. We work with nonprofits like PAWS, Humane Society, SPCA, and other animal-focused organizations, plus causes like the ACLU and the Trevor Project.

Congrats! Your little buddy’s policy becomes active just after midnight of the day you sign up. But there’s a few things to keep in mind.

Your pet isn’t eligible for reimbursement the moment you buy your policy. Your new policy has different waiting periods before you can file a claim.

Curious to learn more? We’ve got more info for pet owners on waiting periods here.

At Lemonade, we require a medical record that includes info that covers the last 12 months of their life (plus the 14 day illness waiting period on your policy). If your pet is less than a year old, the medical record should include info from birth through the illness waiting period.

Vets refer to these as SOAP medical records. We’ll need those records before we can process any claims.

Speaking of claims: Although you can sign up for Lemonade on your desktop, you’ll need to download the app in order to file claims—so you might as well do that ASAP! Also, here’s a guide to what to do after getting your pet insurance policy.

Now, go high-five your furry friend!

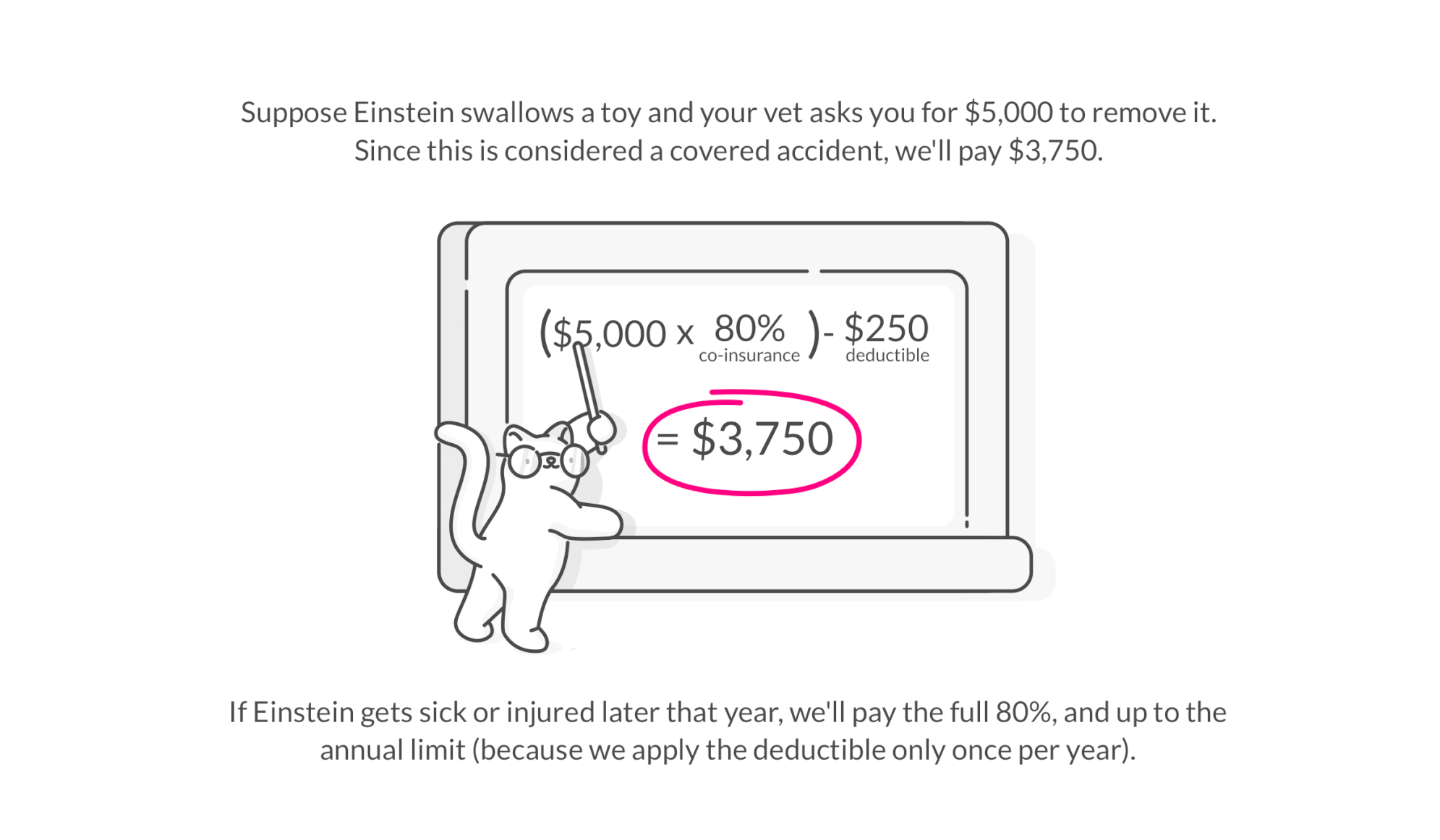

Co-insurance is the percentage of an eligible claim that your pet insurance provider will reimburse you for. At Lemonade, there are 70%, 80%, and 90% co-insurance options available.

At Lemonade, you can make any coverage changes—like adjusting deductibles or adding coverage—within the first 14 days of purchase, provided no claims have been filed. After the first 14 days, coverage upgrades can only be made at renewal.If you are looking to pay less for your coverage, in most states* you can request decreases such as raising your deductible or lowering your co-insurance at any time during the policy period. Keep in mind that all coverage changes will be subject to underwriting approval.

Yes. Having your pet’s health history from the past 12 months, or from birth for pets under a year old, helps in processing claims. Ensuring these records are on file makes for a smoother claims process.

At Lemonade Pet, the deductible is annual, which means it can be exhausted in one big claim, or used up over multiple claims during the policy year. You will need to meet your deductible before you are reimbursed for accident or illness claims.

Yes, you can switch to Lemonade from another provider. One thing to keep in mind is that having coverage with another provider will not waive your waiting periods for a Lemonade Pet policy. If you do choose to switch, it is recommended you wait until some of your waiting periods pass before canceling your prior policy to avoid a gap in coverage.

*Not available in New Hampshire or California

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage and discounts may not be available in all states.

Please note: Lemonade articles and other editorial content are meant for educational purposes only, and should not be relied upon instead of professional legal, insurance or financial advice. The content of these educational articles does not alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. While we regularly review previously published content to ensure it is accurate and up-to-date, there may be instances in which legal conditions or policy details have changed since publication. Any hypothetical examples used in Lemonade editorial content are purely expositional. Hypothetical examples do not alter or bind Lemonade to any application of your insurance policy to the particular facts and circumstances of any actual claim.