Car insurance doesn’t have to be confusing. At Lemonade Car, we work hard to make it simple, easy, and even kind of fun!

In this guide we’ll break down the different coverage options offered by Lemonade Car insurance, in plain English.

Then we’ll take a spin through some real scenarios to see what is covered by different types of car insurance coverage.

Here’s what we’ll discuss:

- What are the different types of car insurance coverage?

- What the heck is ‘full coverage’?

- Real world examples of how Lemonade Car works

- What does car insurance not cover?

- Does car insurance cover routine maintenance?

- How are car insurance policies priced?

- How does car insurance work?

What are the different types of car insurance coverage?

Let’s break down some of the required coverages you’ll need to include—and the optional coverages you might want to add—to your car insurance policy.

Here are the coverages we’ll be tackling:

Medical payments coverage (MedPay)

Personal injury protection (PIP)

Underinsured motorist coverage

Temporary transportation coverage

One important thing to note is that the car insurance policy you customize is actually a collection of different coverages, each with their own focus, and each with their own limits and deductibles.

When you’re pondering your ideal car insurance policy, you might just ask yourself, “what can keep me, my car, and my wallet safe from the unpredictable world around me?”

To answer that question (and to start building your policy) you might want to include more than the legal minimum requirement. It’s true: Adding more coverage to your policy usually means higher insurance costs, but it could also save you a lot of time, money, and aggravation in the long run.

So, what do the different coverages all mean? (Keep in mind: Depending on where you live, some of them might not be available.)

Liability coverage

If you’re a law-abiding driver (and we know you are), you’re required in almost every state to have at least some liability insurance coverage to be on the road.

If you have renters or homeowners insurance, you might already be familiar with this type of coverage. In car insurance, liability coverage is broken down into two parts: bodily injury liability and property damage liability.

- Bodily injury liability coverage. If you accidentally injure someone else who is not a passenger in your car, this will cover their medical bills

- Property damage liability coverage. If you damage someone’s car or personal property, this will cover the cost to repair or replace what was damaged

Example: You run a red light and T-bone a car at an intersection. The other car has significant damage, and the driver suffers a mild concussion. Your property damage liability coverage will cover the costs of the other car’s repairs, and your bodily injury liability coverage will cover the medical bills for the other driver.

Collision coverage

Collision insurance coverage helps pay to repair or replace your own car if it’s damaged in an accident with another vehicle or object, especially if you’re the one who’s responsible. If you’re technically at fault for the damages to your car, your collision coverage will kick in to cover repairs, and get you back on the road.

Let’s say you aren’t paying attention and you hit a road partition in the middle of the highway. No other vehicles are involved, but your car is pretty messed up. The repairs would be covered by your collision coverage after the deductible has been met.

Comprehensive coverage

Also known as “act of god” coverage, comprehensive insurance coverage helps pay to fix damage to your car or possibly replace it from an incident that wasn’t a car accident.

That means if your car is stolen, vandalized, or has an unexpected rendezvous with an animal, for example, comprehensive coverage kicks in to repair or replace your car.

Picture this: You park your car on the street, and gale force winds uproot a tree, which then falls and totals your car. Replacing your car would be covered by your comprehensive coverage, minus your deductible.

Medical payments coverage (MedPay)/Personal injury protection (PIP)

It’s not pleasant to think about, but if you or other passengers in your car get hurt in a car accident, this coverage comes into play, regardless of who was at fault.

Depending on where you live, you will have the option to add either personal injury protection (PIP) or medical payments (MedPay) coverage to your car insurance policy.

MedPay is usually optional, whereas some states require that a car insurance policy includes PIP—like Oregon.

MedPay covers some medical expenses, including, but not limited to:

- Ambulance fees after an auto accident

- X-rays, surgeries, or a prostheses

- Health insurance co-pays

- Doctors and hospital visits

- Nursing services

- Funeral services

PIP is basically the same as MedPay, but it also includes:

- A percentage of your lost wages as a result of your injuries

- Childcare or house cleaning expenses

Also, PIP is sometimes referred to as no-fault insurance because it covers medical expenses from an at-fault accident, no matter who is at fault.

Imagine this: You drive off the side of the road and hit a tree. You end up breaking your wrist, and require an X-ray and a cast. Your medical costs will be covered by PIP or MedPay coverage.

Uninsured motorist coverage

As we said earlier, in order to be a law-abiding driver, you need to have some sort of liability coverage. But unfortunately, not everyone follows the rules. If you are injured or your car is damaged by an uninsured driver, you could be left paying a hefty bill at the body shop or at the hospital.

Uninsured motorist coverage is broken down in two ways:

- Uninsured motorist bodily injury coverage (UMBI). This coverage will cover medical bills and lost wages related to injuries caused by an uninsured driver.

- Uninsured motorist property damage coverage (UMPD). If you get into a car accident with an uninsured driver, this coverage will cover the costs of repairing your vehicle.

Example: An uninsured driver makes an illegal right turn, causing a car accident, which damages your side door. Your uninsured motorist property damage would cover the costs.

Underinsured motorist coverage

Sometimes, even if an at-fault driver does have liability coverage, the coverage isn’t enough to cover major expenses after an accident. In order to avoid paying the difference in repair and medical costs, you would need to purchase underinsured motorist coverage.

This coverage is also broken down in two ways, the same as uninsured motorist coverage.

- Underinsured motorist injury coverage (UIMBI). This coverage will cover remaining medical bills and lost wages related to injuries caused by an underinsured driver up to your UIMBI policy limits.

- Underinsured motorist property damage coverage (UIMPD). If you get into a car accident with an underinsured driver, this coverage will cover the remaining costs of repairing your vehicle up to your UIMPD policy limits.

Example: An underinsured driver makes an illegal right turn and ends up wracking up $20,000 in damages to your car. They only have $10,000 in property damage liability coverage, so your underinsured motorist property damage coverage would kick in to cover the remaining $10,000.

Temporary transportation coverage

Lemonade Car goes beyond the typical rental reimbursement if you need alternative transportation while your car is being repaired from a covered incident.

We help cover almost any type of transportation for up to a month while you’re waiting for your car in the shop. This includes taking rideshares—like Uber and Lyft—rental car expenses, or even public transportation like buses or trains, up to your daily limit.

If you have both collision and comprehensive coverage on your car, you’ll get the option of selecting temporary transportation coverage for your car as well.

Example: You get into an accident and your car needs to be in the shop for repairs. In the meantime, you decide to Lyft to and from work. Your Lyft fees would be covered by your Lemonade temporary transportation coverage up to the limit on the policy.

Extended glass coverage

Glass insurance helps pay the cost to repair or replace your car’s damaged windshield.

If you have both collision and comprehensive coverage on your Lemonade policy, you have the option to choose an extended glass coverage that allows you to replace your windshield with little or no deductible, depending on where you live.

Example: You’re cruising on the highway and a rock cracks your windshield. Since you have extended glass coverage, you get your windshield fixed with little or no deductible.

Roadside assistance

Roadside assistance provides towing and other emergency roadside services like lockout services, flat tire replacement, jumpstarts for dead batteries, fuel delivery, winching and battery service if your car breaks down.

Lemonade Car includes roadside assistance as part of a car insurance policy when users drive with the Lemonade app (and when the policy includes comprehensive and collision coverages). It’s included for each car listed and covered by a Lemonade insurance policy as long as the user’s account is set up correctly in the Lemonade app.

For our Oregon drivers, roadside assistance is an optional coverage you can include on your policy.

Example: Your car’s battery dies in the middle of the road. You request roadside assistance on your Lemonade app, and one of Lemonade’s roadside partners is dispatched to help you. When they arrive, they give you a jump and you can continue on your way, free of charge.

What the heck is ‘full coverage’, and does it mean what I think it does?

Full coverage car insurance is a combination of insurance coverages designed to ‘fully’ cover you in the event of an accident. This would include coverages that aren’t legally required, but that would give you extra peace of mind in many different scenarios.

It’s important to understand that it doesn’t mean you’re covered for everything, nor does it guarantee your insurance claim will be approved. Full coverage car insurance combines various coverage options and endorsements to fully cover you up to any applicable limits you selected. It’s a single policy you build with your insurance company to provide the best combination of coverage for you.

If you want to feel fully covered by your Lemonade Car policy, your coverage could include a combination of collision and comprehensive insurance, in addition to bodily injury, property damage, temporary transportation coverage, and extended glass coverage.

It’s basically the Tesla Model Y of car insurance. Keep in mind that deductibles will apply for most of these coverages, and you’ll only be covered up to the coverage limits you set.

Some real-world examples of how Lemonade Car works

We understand that car insurance can be confusing, so we’ve broken down several common, but perhaps less cut-and-dry scenarios where various coverages would come in handy.

I’m driving and I hit a deer. The road is empty—no other cars involved—but my car is really messed up.

Is it covered? Yes!

Which part of my policy? Comprehensive coverage

Anything else I need to know? Nope, just go ahead and file a claim on the Lemonade app to start the repair process, and call for roadside assistance if needed. If the deer has been injured, call the authorities so they can dispatch someone to assist.

I’m driving and I hit a deer, which immediately causes me to crash into another car.

Is it covered? Yes

Which part of my policy? Collision coverage to repair your car, and liability coverage to repair the other person’s car

Anything else I need to know? Nope, just file a claim on the Lemonade app.

My car is broken into and the vehicle is stolen.

Is it covered? Yup!

What part of my policy? Comprehensive coverage will help replace your car

Anything else I need to know? Check your state’s requirements about how long you need to wait after filing a police report for a stolen vehicle before you can file a claim. The sooner you tell the authorities your car has been stolen, the more likely they are to find it.

I’m not paying attention and I run into a highway divider, seriously messing up my car…

Is it covered? Yes

What part of my policy? Collision coverage (for your car’s damage) and property damage liability (for the poor highway divider).

Anything else I need to know? Nope, just file a claim on the Lemonade app.

I rear-end someone else’s car, damaging my car and their car, and hurting the other driver.

Is it covered? Yes

What part of my policy? Your collision coverage will pay for repairs to your car, your property damage liability coverage will pay for repairs to the other car, and your bodily injury liability coverage will pay for the other driver’s medical expenses.

Anything else I need to know? Nope, just file a claim on the Lemonade app.

A thief smashes my window and steals my car radio and a suitcase full of clothes. What happens—can I get compensated for my window, my radio, and my stuff?

Is it covered? Yes and no (and yes!).

What part of my policy? Your comprehensive coverage will cover the costs to repair your windows and replace your car radio. Car insurance won’t cover your clothing, but your renters or homeowners insurance probably will.

Anything else I need to know? Nope, just file a claim (or two, if you have renters or homeowners insurance as well) on the Lemonade app.

What will my Lemonade car insurance policy not cover?

All insurance policies vary, so it’s good to have a basic grasp of what yours does (and doesn’t) cover.

Some of the reasons a Lemonade Car policy can’t cover damage include:

- Using your car as a way to make additional income—like through ridesharing platforms—or if it’s affiliated with your company or business

- Intentionally damaging your car

- Damaging custom parts on your car—like custom color changing LED headlights

Get the full scoop on what car insurance doesn’t cover here.

Does car insurance cover routine maintenance?

Nope. You’re responsible for giving your ride the TLC it deserves—like regular oil changes and rotating your tires. If you file an insurance claim and the adjuster determines that the damage to your vehicle is from normal wear and tear, you’ll have to pay for those repairs yourself.

The same applies to cosmetic issues that may happen over time—for instance, if your nice leather seats become sun-damaged. That would be considered wear and tear that’s not covered by your insurance policy.

How does Lemonade Car price policies?

There are lots of variables that factor into the cost of car insurance, including:

- Your insurer

- The state you live in

- Your driving history and driving habits

- Your car’s make and model year

- The additional drivers you include

- The specific coverages, limits, and deductible you include on your policy

At Lemonade Car, the way you drive matters. From mileage to behind-the-wheel behavior to driving history, we crunch a ton of numbers to help us determine the fairest price for your car policy.

Want to learn more about what influences the price you pay for car insurance? Read on here.

But the most straightforward way to get a sense of how we price car insurance premiums is by applying for coverage. It’s fast, easy, and simple to compare.

How does car insurance work?

Car insurance is a collection of coverages designed to protect you and your car when you’re on the road, parked, or in your driveway—like helping with the costs to repair the damage from Sasquatch leaving a footprint on your car’s roof while you’re camping in Eagle Cap wilderness area.

A Lemonade Car policy can cover you for damage to your car caused by accidents, vandalism, extreme weather, fire, and falling objects, and a whole lot more—but keep in mind that your specific protection will depend on how you build your policy.

The good news is that Lemonade Car coverage is super customizable—both when you build your quote, and at any time during your policy term—all on the Lemonade app. You’ll have the power to see and make changes to your coverage, limits, deductibles, start date, and more literally in the palm of your hand.

Just a refresher: A “limit” in regard to your auto insurance policy refers to the maximum amount your insurer would pay out on a certain type of claim.

For example, Texas drivers are required to have a minimum of $30,000/$60,000 of bodily injury liability coverage. That means that for a certain type of claim your car insurance company could pay out a maximum of $30,000 of bodily injury coverage per person, and $60,000 of bodily injury coverage in total (for all of the people injured in an accident.)

It’s also important to keep in mind that required coverages and minimums vary by state. But you’ll likely want more coverage than the bare bones version you’re required to get.

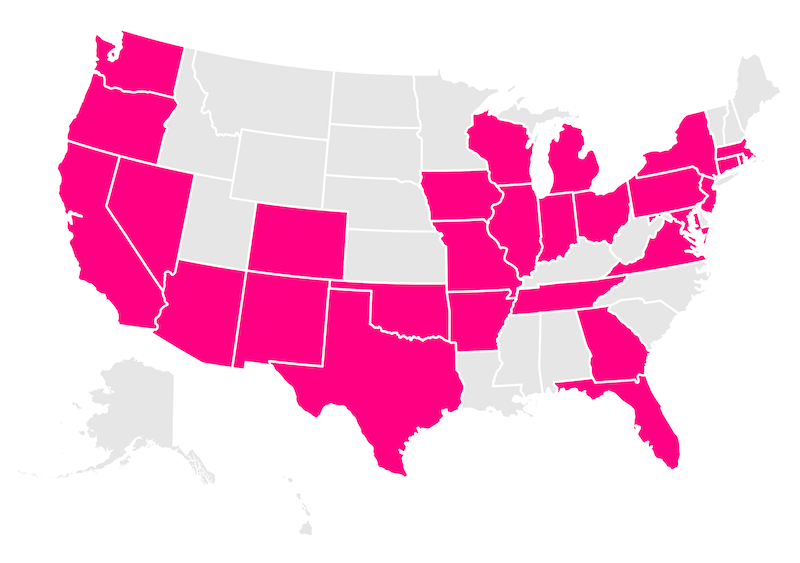

Which states currently offer Lemonade Car insurance?

Arizona, Illinois, Ohio, Oregon, Tennessee, Texas, and Washington.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage may not be available in all states.